Final theses

The Professorship International Business Taxation offers supervision of Bachelor's and Master's theses from the winter semester 2024/2025. In principle, all topics from the field of national and international business taxation are conceivable. However, a particular focus of the professorship is currently on the topics listed below. However, these should be seen more as a rough guide than as specific titles for theses.

Bachelor

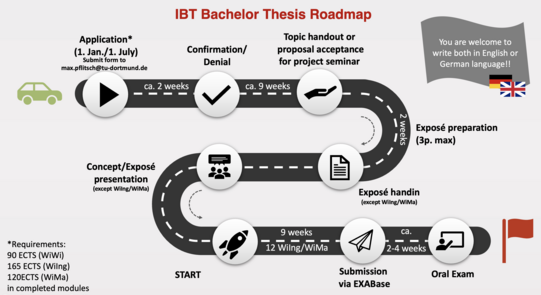

If you would like to write your Bachelor's thesis at our professorship, you can apply online by Januar 1st (for the following summer semester) or July 1st (for the following winter semester) with the following documents:

- Bachelor's or Master's application form

- Curriculum vitae in tabular form

- current overview of grades

Please send the documents in one (!) unsigned PDF file to max.pflitsch@tu-dortmund.de. Application documents with more than one PDF file cannot be considered!

You will receive an acceptance or rejection letter from us within two weeks of receipt of your application after we have checked your documents and the number of places available in the semester. If you are accepted for a Bachelor's thesis, please note that you must complete the project seminar before starting your Bachelor's thesis. You will be automatically registered for this.

Within approx. 4 weeks, you will be assigned a topic or proposed a topic for a project seminar. Students enrolled in the Bachelor of Business Administration and Economics must prepare an exposé of a maximum of 3 pages and submit it after a maximum of 2 weeks (with the exception of students of industrial engineering and business mathematics). After the exposé has been submitted, a presentation of the concept or exposé takes place (with the exception of students of industrial engineering and business mathematics).

The Bachelor's thesis starts after the presentation. Students on the Economics degree program have 9 weeks to submit their Bachelor's thesis via EXABase. Students on the Industrial Engineering and Management and Business Mathematics degree programs have 12 weeks to submit their Bachelor's thesis via EXABase. After submission of the Bachelor's thesis, the oral defense takes place.

Please also note that you need the following ECTS in completed modules to register, depending on your degree program: 90 ECTS for Economics, 165 ECTS for Industrial Engineering or 120 ECTS for Business Mathematics.

Please also note that, according to the examination regulations, you must have at least 120 CP in completed modules at the time of registration at the examination office. You are welcome to write your thesis in English or German.

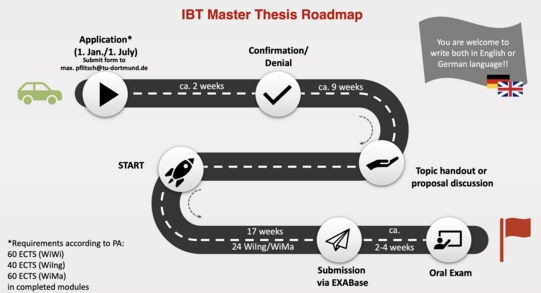

If you would like to write your Master's thesis at our professorship, you can apply online by January 1st (for the following summer semester) or July 1st (for the following winter semester) with the following documents:

- Bachelor's or Master's application form

- Curriculum vitae in tabular form

- current overview of grades

Please send the documents in one (!) unsigned PDF file to max.pflitsch@tu-dortmund.de. Application documents with more than one PDF file cannot be considered!

You will receive an acceptance or rejection letter from us within 2 weeks of receipt of your application after we have checked your documents and the number of places available in the semester.

In consultation with your supervisor, the topic will be discussed or proposed. Please note that in accordance with Section 13 (3) sentence 1 MPO 2019, the topic of the Master's thesis should generally be chosen from the study profile taken in accordance with Section 12 (1) sentence 3 MPO 2019 (in this case study profile A: Accounting & Finance).

The Master's thesis is then started. Students on the Business and Economics degree program have 17 weeks to submit their Master's thesis via EXABase. Students on the Industrial Engineering and Management and Business Mathematics degree programs have 24 weeks to submit their Master's thesis via EXABase. After submission of the Master's thesis, the oral defense takes place.

Please also note that you need the following ECTS in completed modules to register, depending on your degree program: 60 ECTS for Business Administration and Economics, 40 ECTS for Industrial Engineering and Management or 60 ECTS for Business Mathematics. According to the examination regulations, you must have at least 60 CP in completed modules at the time of registration at the examination office. You are welcome to write your thesis in English or German.

Relevant documents

Bachelor's/Master's application form

Guidelines for the formal design

Bachelor´s and master´s theses must always include a affidavit. For details please refer to the website of department 4.